January 9, 2023

Loan Officer, Investor, C-Suite, Closing and Settlement, Home Price Index HPI, Industry News, Property Valuations, Technology, TitleThe Untapped Potential of Home Equity Lending

The pandemic has affected nearly every industry in some way or another, and the housing and mortgage market is no different. Mortgage rates reached historic lows, technology paved the way to keep work moving, and many potential buyers shifted to prioritize “home office space” on their wish lists.

But as the industry begins to stabilize, new trends are emerging that lenders should be aware of, including the return of home equity loans and HELOCs. Here are just three of the reasons why now is the time to take advantage of this market.

Increased Mortgage Rates, Decreased Refinancing

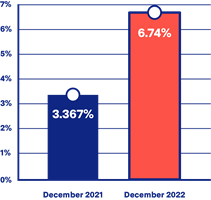

On December 31st, 2021, the average 30-year fixed mortgage rate was 3.367%.[1] Because of these low rates, cash-out refinancing made a lot of sense for homeowners looking to tap into their home’s equity. In fact, nearly one-fourth of all homeowners with a mortgage benefited from refinancing in 2021.[2]

Fast forward to a year later when the average 30-year fixed mortgage rate has doubled to a whopping 6.74%.[3] Because of this, many homeowners are searching for new ways to tap into their home’s equity. Home equity loans and HELOCs provide a solution for those seeking to access the equity in their homes without bumping up their interest rates.

Historically High Home Costs

Over the past few years, we’ve seen average home prices reach historic highs. The median home sale price in 2022 was $386,300—up 10.2% from 2021, and the highest on record according to data from the National Association of Realtors.[4] For homeowners, the rising values mean a boost in their tappable equity, which they can take advantage of through home equity loans and HELOCs.

Over the past few years, we’ve seen average home prices reach historic highs. The median home sale price in 2022 was $386,300—up 10.2% from 2021, and the highest on record according to data from the National Association of Realtors.[4] For homeowners, the rising values mean a boost in their tappable equity, which they can take advantage of through home equity loans and HELOCs.

In addition, many homeowners who previously considered moving are now rethinking. Reinvesting and renovating a current home suddenly seems much more appealing than buying a new property at a high price and high interest rate.

Lower Inventory of Available Homes

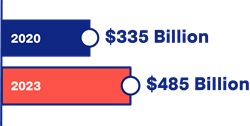

Finally, the low supply of available homes is also causing many homeowners to make the most of their current property.[5] Rather than getting into a bidding war and potentially overspending, many Americans are opting to remodel their current home instead. According to Harvard research, the annual spending on home improvements and repairs has consistently grown since 2020 and is expected to reach nearly $485 billion in 2023.[6] Home equity loans and HELOCs give homeowners the cash they need to complete these projects.

Say Hello to HELOC with Radian and homegenius

With all these factors at play, there’s never been a better time to help your clients explore their options through home equity lending. Discover the power of our all-in-one suite of solutions to get started.

Across Radian and homegenius, we offer services ranging from valuations and property condition reports to seamless title workflows. Because everything you need is in one place and backed by industry-leading technology, you’ll save time, money, and the hassle of juggling multiple systems.

Mortgage Insurance Premiums are Tax-Deductible: What it Means for Borrowers

Mortgage insurance (MI) premiums are once again tax-deductible, and this time, the benefit is here indefinitely. Learn more about what that means for borrowers and loan officers.

.png?rev=c7f6e1de03984af48e8696294f18ff9b&h=800&w=1200&la=en&hash=CD24F065956D7DF9B2710A6060C26226)

Title Insurance Market Poised for Growth: How Can Title Agents Seize the Opportunity?

Title insurance market poised for steady growth through 2034. Discover strategies for title agents to capitalize on emerging opportunities.

.png?rev=85d2748183c344378e2417c08f2efb1e&h=800&w=1200&la=en&hash=58A74A07860BB808A26302C1FD1A03C3)

More Than a Provider: Find the Underwriter That Grows with Your Agency

Title insurance claims have increased in recent years, demonstrating the importance of an experienced title underwriter. Learn more about various factors to evaluate when selecting an underwriter to add to your agency's network of providers.

.png?rev=82091bd603814828a7aa8f73c7b87b97&h=800&w=1200&la=en&hash=7F4311FB35EF2B8F11352FD7C9370B35)

4 Strategies to Help Real Estate Investors Shrink Closing Costs

Getting to the closing table can be exhausting and expensive. Real estate investors shouldn't miss out on untapped potential for savings. Learn about four actionable strategies you can implement at closing that may help you save.

The $638 Million Reason to Choose Your Title Company Wisely

The title company real estate investors choose can play a critical role in their investments. Making an informed decision on this often-overlooked aspect can help impact their long-term success. Learn more about what to consider when searching for a title company.

Navigating the Spring Market: Tips for Buying or Selling Your Home

Spring is the busiest season in real estate, with warmer weather and blooming flowers highlighting a property's best features, and buyers prioritizing home tours before family obligations. Take a look at our checklists to help buyers and sellers prepare for the upcoming busy market.

4 Ways Real Estate Agents Can Prepare for the Spring Market

Real estate agents looking to capitalize on the spring market season can benefit from four key strategies to help optimize their busy season. These actionable tips emphasize proactive client outreach and process streamlining. From leveraging existing client portfolios to implementing digital tools for transaction management, the guidance offers practical steps for agents to help strengthen their market position and drive growth.

Why Buying a Home Still Makes Sense in Today's Market: A 2025 Perspective

In today's real estate landscape, potential homebuyers might hesitate to enter the market. However, despite current challenges, several compelling reasons make homeownership an attractive option. With proper planning and understanding of available options, buying a home in 2025 can be a smart investment in your future.

Help Safeguard Property Transactions: A Deep Dive into Seller Impersonation Fraud

Understand the threat of seller impersonation fraud in real estate transactions. Help safeguard against these fraudulent activities by learning how scammers may use sophisticated methods to impersonate property owners and steal sale proceeds, warning signs to watch for, and potential protective measures including thorough identity verification, title insurance, and settlement services.

Housing Valuation Panel Recap: Is it Time to Sell or Can Values Rise?

In the ever-evolving real estate market, insights from industry leaders can help provide valuable insights for investors.