June 4, 2020

Loan Officer, Industry NewsWhat the New COVID-19 GSE Guidelines Mean for You

As we navigate the impact that COVID-19 has had on our industry, Radian remains dedicated to providing the tools and resources you need to serve borrowers. We have updated our mortgage insurance (MI), title insurance, and real estate services processes to align with COVID-19 GSE announcements and temporary guidelines, and we broadly support borrowers through this hardship through our policies. Here’s a closer look at the changes.

We have implemented temporary flexibilities related to loan origination and closings to support the health and wellbeing of employees, borrowers, and their families. These measures ensure compliance with government safety guidelines and satisfy GSE underwriting documentation requirements.

- Alternatives to traditional property appraisals and interior inspections like exterior-only and desktop appraisals

- Alternatives to verbal verification of employment (VVOE) such as leveraging a year-to-date paystub evidencing a recent payroll deposit

- Powers of attorney flexibilities

- Remote online notarization flexibilities

Many borrowers’ employment and income are being impacted by the economic shutdown, and we strongly encourage lenders to apply thoughtful due diligence for new loan applications.

- Ensure employment, income, and asset verification documentation is dated no more than sixty (60) days from the Note Date.

- If possible, require more recent income documentation and validate employment as close to the loan closing as possible.

- Watch for income and employment documentation that shows that the borrower is furloughed or there is a curtailment in income.

- Confirm that a self-employed borrower’s business is currently operating such as obtaining executed contracts or signed invoices that indicate the business is operating on the day the lender verifies self-employment or current receipts for services performed within 10 days of the Note Date.

- Follow GSE down-payment requirements to liquidate the equity-based asset or discount the value if used for reserves.

- Remember that unemployment benefits can only be used as qualifying income if associated with seasonal employment and that the income of a furloughed borrower is not eligible under the temporary leave income policy.

Don’t forget: Servicers must continue monthly Default and Loss Mitigation reporting to Radian, including loans that miss payments under a COVID-19 related workout.

Use Default Reason Code 12 for all defaults caused by COVID-19-related hardships.

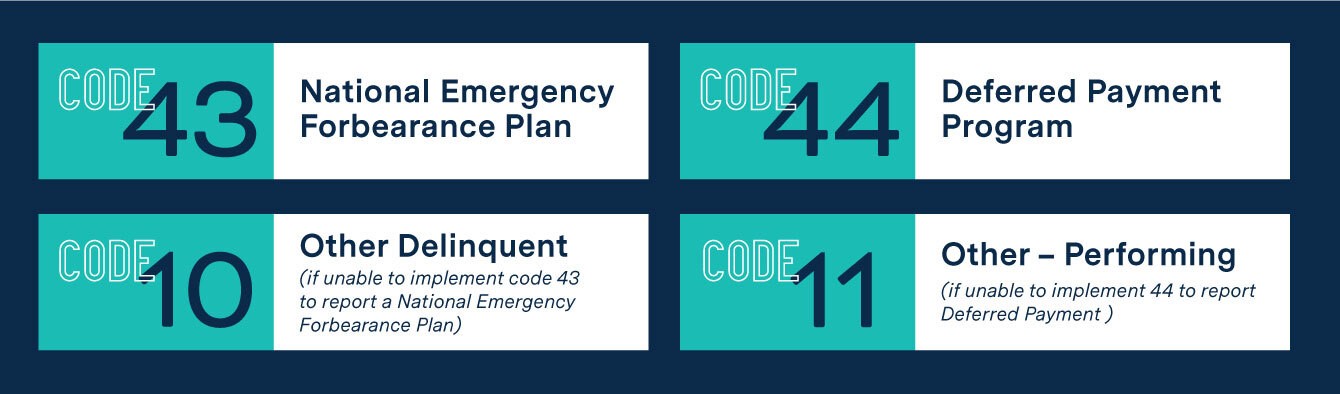

Use the Loss Mitigation Workout codes below for loans in a forbearance plan due to a COVID-19-related hardship.

Radian is here to help as you assist new and existing borrowers during these unprecedented times. For more information, which will be updated as needed, please visit www.radian.com/covid-19 or contact your Radian Account Manager.

Mortgage Insurance Premiums are Tax-Deductible: What it Means for Borrowers

Mortgage insurance (MI) premiums are once again tax-deductible, and this time, the benefit is here indefinitely. Learn more about what that means for borrowers and loan officers.

Navigating the Spring Market: Tips for Buying or Selling Your Home

Spring is the busiest season in real estate, with warmer weather and blooming flowers highlighting a property's best features, and buyers prioritizing home tours before family obligations. Take a look at our checklists to help buyers and sellers prepare for the upcoming busy market.

Why Buying a Home Still Makes Sense in Today's Market: A 2025 Perspective

In today's real estate landscape, potential homebuyers might hesitate to enter the market. However, despite current challenges, several compelling reasons make homeownership an attractive option. With proper planning and understanding of available options, buying a home in 2025 can be a smart investment in your future.

Help Safeguard Property Transactions: A Deep Dive into Seller Impersonation Fraud

Understand the threat of seller impersonation fraud in real estate transactions. Help safeguard against these fraudulent activities by learning how scammers may use sophisticated methods to impersonate property owners and steal sale proceeds, warning signs to watch for, and potential protective measures including thorough identity verification, title insurance, and settlement services.

Housing Valuation Panel Recap: Is it Time to Sell or Can Values Rise?

In the ever-evolving real estate market, insights from industry leaders can help provide valuable insights for investors.

Single-Family Rental Market Insights: What Investors Need to Know for 2025

The recent IMN Single-Family Rental (SFR) West Forum in Scottsdale, Arizona provided valuable perspectives on the current and future state of the SFR market. Industry leaders shared compelling insights that demonstrate the resilience and evolving nature of this space.

Beyond the Rate Drop: Helping to Future-Proof Your Lending Strategy

The recent drop in interest rates may lead to an influx of purchase and refi volume for lenders. With this shift on the horizon, learn more about positioning yourself to meet customer needs and help borrowers at scale through proper use of technology and innovative solutions.

Homebuying Trends in the United States

Discover the state of homeownership in the US, including the significant disparities across racial and ethnic lines and the challenges that homebuyers face. Learn about the importance of addressing these disparities and creating more equitable pathways to homeownership for building wealth and ensuring accessibility for all.

Debunking 7 Common Mortgage Myths

The homebuying process can be exciting, but it can also be overwhelming, especially when it comes to mortgages. There's a lot of information out there, but not all of it is accurate. In this article, we debunk some common mortgage and PMI myths to help borrowers make better informed financial decisions.

Explore the Evolving Traits of First-Time Homebuyers

Our infographic explores the characteristics and behaviors of today's first-time homebuyers, who prioritize homeownership as an important part of the American Dream despite economic and societal changes.