January 9, 2023

Loan Officer, Investor, C-Suite, Closing and Settlement, Home Price Index HPI, Industry News, Property Valuations, Technology, TitleThe Untapped Potential of Home Equity Lending

The pandemic has affected nearly every industry in some way or another, and the housing and mortgage market is no different. Mortgage rates reached historic lows, technology paved the way to keep work moving, and many potential buyers shifted to prioritize “home office space” on their wish lists.

But as the industry begins to stabilize, new trends are emerging that lenders should be aware of, including the return of home equity loans and HELOCs. Here are just three of the reasons why now is the time to take advantage of this market.

Increased Mortgage Rates, Decreased Refinancing

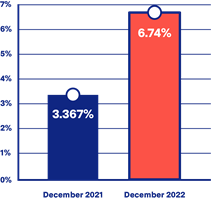

On December 31st, 2021, the average 30-year fixed mortgage rate was 3.367%.[1] Because of these low rates, cash-out refinancing made a lot of sense for homeowners looking to tap into their home’s equity. In fact, nearly one-fourth of all homeowners with a mortgage benefited from refinancing in 2021.[2]

Fast forward to a year later when the average 30-year fixed mortgage rate has doubled to a whopping 6.74%.[3] Because of this, many homeowners are searching for new ways to tap into their home’s equity. Home equity loans and HELOCs provide a solution for those seeking to access the equity in their homes without bumping up their interest rates.

Historically High Home Costs

Over the past few years, we’ve seen average home prices reach historic highs. The median home sale price in 2022 was $386,300—up 10.2% from 2021, and the highest on record according to data from the National Association of Realtors.[4] For homeowners, the rising values mean a boost in their tappable equity, which they can take advantage of through home equity loans and HELOCs.

Over the past few years, we’ve seen average home prices reach historic highs. The median home sale price in 2022 was $386,300—up 10.2% from 2021, and the highest on record according to data from the National Association of Realtors.[4] For homeowners, the rising values mean a boost in their tappable equity, which they can take advantage of through home equity loans and HELOCs.

In addition, many homeowners who previously considered moving are now rethinking. Reinvesting and renovating a current home suddenly seems much more appealing than buying a new property at a high price and high interest rate.

Lower Inventory of Available Homes

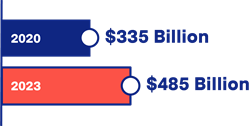

Finally, the low supply of available homes is also causing many homeowners to make the most of their current property.[5] Rather than getting into a bidding war and potentially overspending, many Americans are opting to remodel their current home instead. According to Harvard research, the annual spending on home improvements and repairs has consistently grown since 2020 and is expected to reach nearly $485 billion in 2023.[6] Home equity loans and HELOCs give homeowners the cash they need to complete these projects.

Say Hello to HELOC with Radian and homegenius

With all these factors at play, there’s never been a better time to help your clients explore their options through home equity lending. Discover the power of our all-in-one suite of solutions to get started.

Across Radian and homegenius, we offer services ranging from valuations and property condition reports to seamless title workflows. Because everything you need is in one place and backed by industry-leading technology, you’ll save time, money, and the hassle of juggling multiple systems.

The American Dream of Homeownership Starts with Financial Literacy

As we celebrate National Financial Literacy month this April, it’s a reminder of the important role that financial literacy plays in preparing for the homebuying journey. Learn more about financial literacy for homebuyers.

Preparing to Buy or Sell a Home in the Spring

Spring is the busiest season in real estate, with warmer weather and blooming flowers highlighting a property's best features, and buyers prioritizing home tours before family obligations. Take a look at our checklists to help buyers and sellers prepare for the upcoming busy market.

4 Simple Steps for Loan Officers to Build Lasting Relationships in 2024

Using these 4 Simple Steps, Loan Officers can help their elevate business and redefine success in 2024 by building strong relationships with real estate agents, prior clients, local community organizations, and other trusted service providers.

The Millennial and Gen Z Homebuyer

Recognizing and understanding behaviors of Millennial and Gen Z homebuyers can empower loan officers and real estate agents to engage these distinct generations of homebuyers.

Radian Launched Affordable Housing Crisis White Paper

Learn more about how increasing mortgage rates, skyrocketing home costs, and a lack of supply in the market have left many wondering if they will ever be able to afford a home.

Understanding the Next Generation of Homebuyers - The ABCs of Gen Y and Z

There is a new generation of homebuyers emerging in the market. What should loan officers and mortgage brokers know about this next generation of homebuyers?

Are you ready for the Great Rebound in Self-Employed Borrowers?

Are you ready for the Great Rebound in self-employed borrowers? In this infographic you will learn more on what's behind the great rebound in self-employment and more. Check out this infographic that provides statistics on the big resignation, the growth in remote working and the grow in gig work.

Woman of Influence: Emily Riley

Emily Riley shares insights on what it means to be a woman leader in the housing industry.

Bidding Wars, Cash Offers, Record High Prices: What You Need to Know

With bidding wars, cash offers, and record high prices, find out what you need to know about appraisal contingencies in today’s housing market.

Radian Technology in Action

Amid a global pandemic that has accelerated the demand and need for digital products and services, we are at the forefront, delivering new and better ways to manage credit risk and execute real estate transactions.